Why You Should Understand the Technology

Crypto's wild west is littered with retail investors chasing hype, blindly following the latest influencer buzz without a shred of real research. Meanwhile, the big guns – the institutional players – dig deep, analyze, and play the long game.

The TERRA Blockchain disaster of 2022: a so-called "blue-chip" that plummeted to oblivion overnight and wiped out 30 billions dollars, all while the signs were glaring in the publicly available documentation.

In this chaos, investment is a skillful dance between riding the memes, the wave of irrational exuberance and holding onto solid, informed strategies.

Bottom line: Crypto's a giant online casino, where 2-digit IQ plebs meet 2-to-3-digit IQ institutionals, but is also a genuine forefront of financial innovation, so you better strap in with more than just hope.

"To ape in, or not to ape in, that is the question"

Crypto retail investors often fall into the trap of basing their investment decisions on influencers they deem trustworthy. However, the foundation of this trust is frequently shaky, built on mere appearances instead of competence or integrity.

In an ideal scenario, an investor would meticulously research and analyze potential investments before committing funds. The problem is, retail investors lack the technical acumen required to dissect these complex projects. Despite this gap in understanding, the allure of the crypto market is too tempting to resist.

As a result, many take a shortcut. They latch onto the next appealing voice they come across online, someone who seemingly speaks with authority. Whether these individuals are genuinely knowledgeable or just a well-orchestrated facade with solely their own financial interests in mind, the average investor does not discern the difference. The combination of compelling narratives and investors greed clouds their judgment; You owe it to yourself to know where you're throwing your money.

"Dumb Money" vs "Smart Money"

Here is the behavior you can generally expect from investors, depending on whether they do this professionally or not.

Retail Investors:

- Sees a tweet or hears about some coin that's "going to the moon."

- Thinks everyone's getting rich, and they don't want to be left out.

- Maybe checks a couple of forums, watches a YouTube video, or skims a news article.

- Goes with the flow, believes in the hype because "everyone else does."

- Throws money at the coin and prays it flies.

- If the coin drops, they're selling in fear. If it rises, they're telling everyone they're a genius.

- Mostly flying by the seat of their pants, often with no exit plan.

Sophisticated Investors:

- Hears about a potential investment opportunity.

- Digs deep into market trends, whitepapers, project team, technology behind it, competition, and potential market cap.

- Evaluates potential risks associated with the investment. Are there regulatory concerns? What's the competition like?

- Sets clear goals for the investment. What's the timeframe? What's the desired ROI?

- Puts money in after getting a green light from all the analysis.

- Keeps a constant eye on the investment, ready to adjust strategy based on market shifts.

- Has a clear plan for when and how to pull out, and it's not based on emotion.

Bottom Line is, retail folks are often playing checkers, while more sophisticated players like institutions are playing 4D chess.

Plebs always get Rekt

Let me tell you the story of TERRA Blockchain, which launched in 2020 and died abruptly in May 2022. Its LUNA token grew to become a top 10 crypto, and its UST token became a top 5 stablecoin. It had over 30 billion dollars invested in it. In short, it was a blue chip.

To be fair, many institutional investors were also involved, including big shots like Mike Novogratz from Galaxy Digital, or Delphi Digital. They thought it was too big to fail. It eventually went to zero overnight, because of the mechanism behind the network’s pair of tokens, designed to maintain the peg of the algorithmic stablecoin UST.

Did you read the Docs?

You would think that people would have enough after such a meltdown, right? Wrong...

Some of them would try to “revenge trade” to make it all back. People can be more irresponsible than you'd think:

$UST and $LUNA could be buy of the century

— That Martini Guy ₿ (@MartiniGuyYT) May 12, 2022

Its worth a speculative punt 👌

But that is because they DON’T understand what they’re buying.

All these people now trying to buy the "cheap" LUNA making me think that schools rly need to update their curriculum-

— Jordi Alexander (@gametheorizing) May 12, 2022

Ditch the biology frog dissection and instead dissect market cap and low price bias.

World of difference between having a fixed supply and variable supply..!

And yet, everything was explained in the documentation.... which most people do not read, because they can't, or they can't be bothered... That single paragraph below is enough to explain why things went down so quickly.

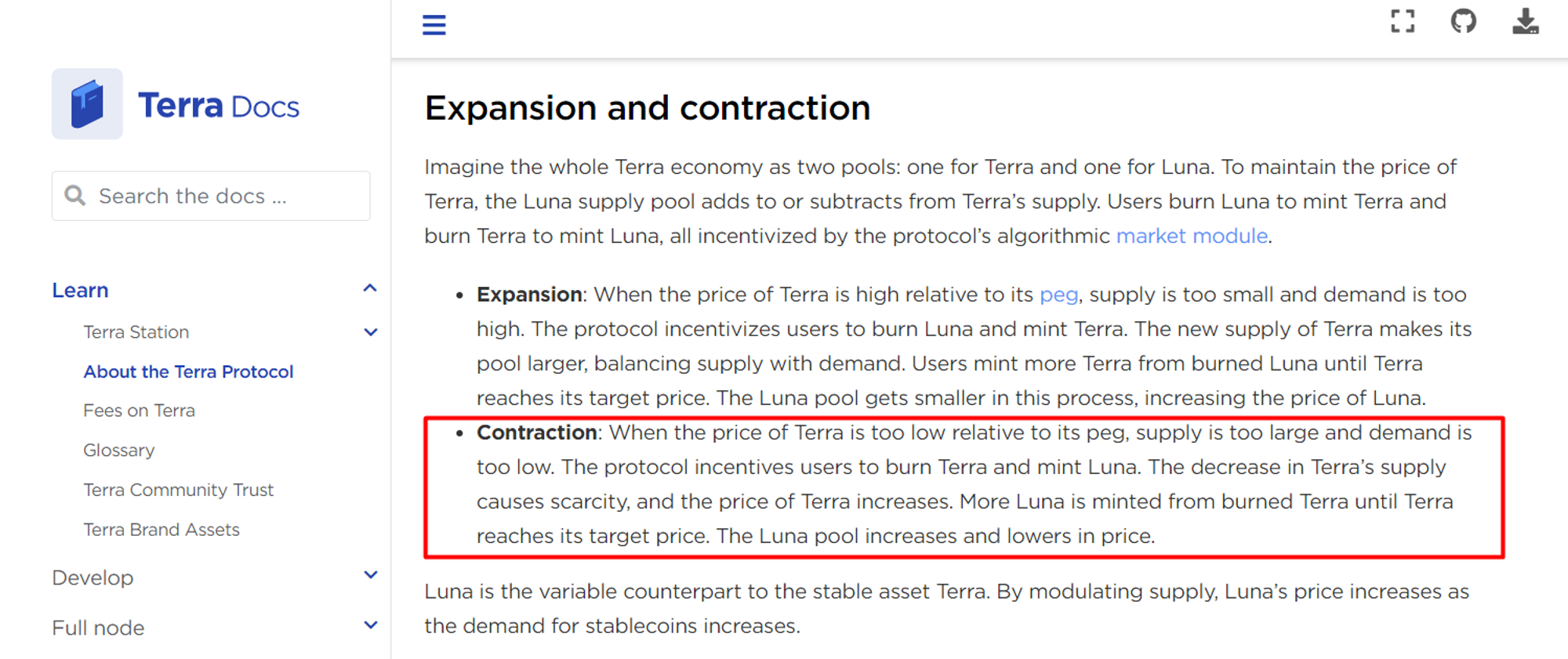

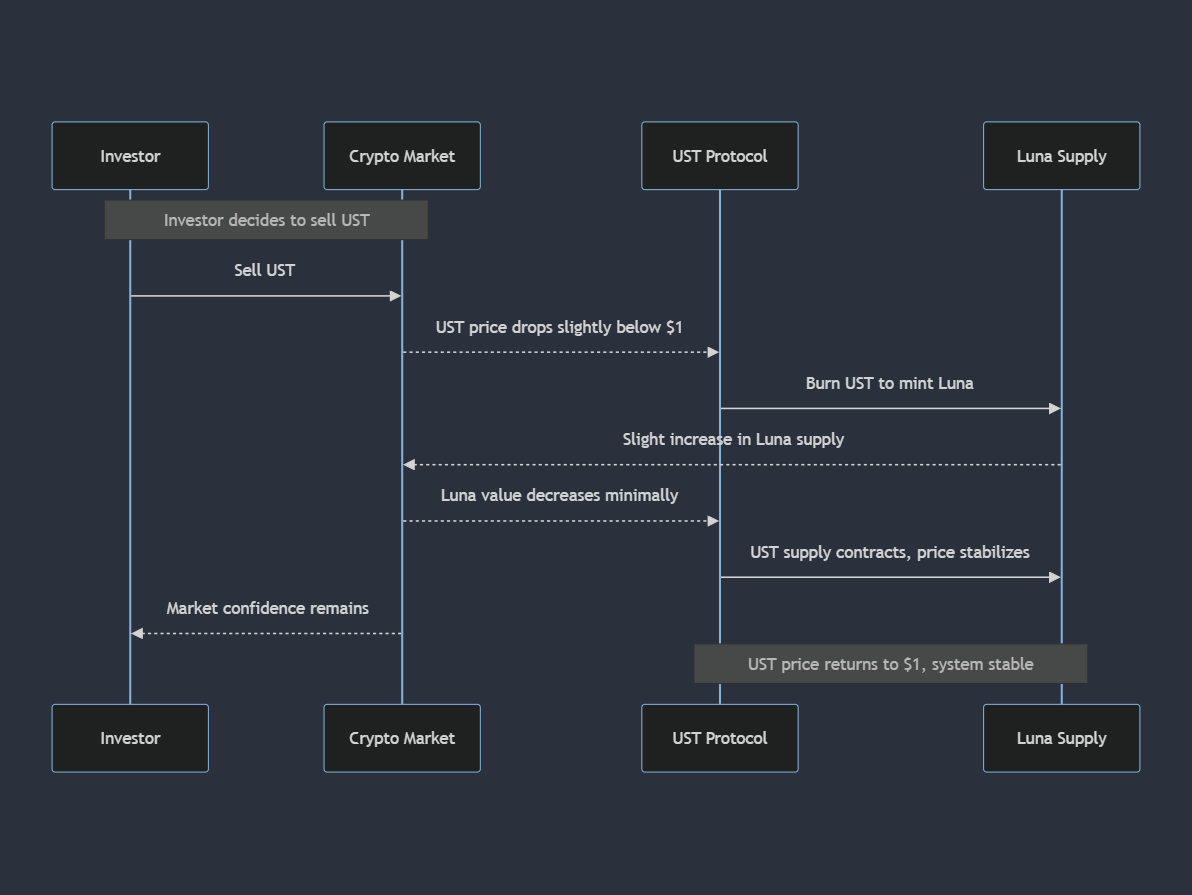

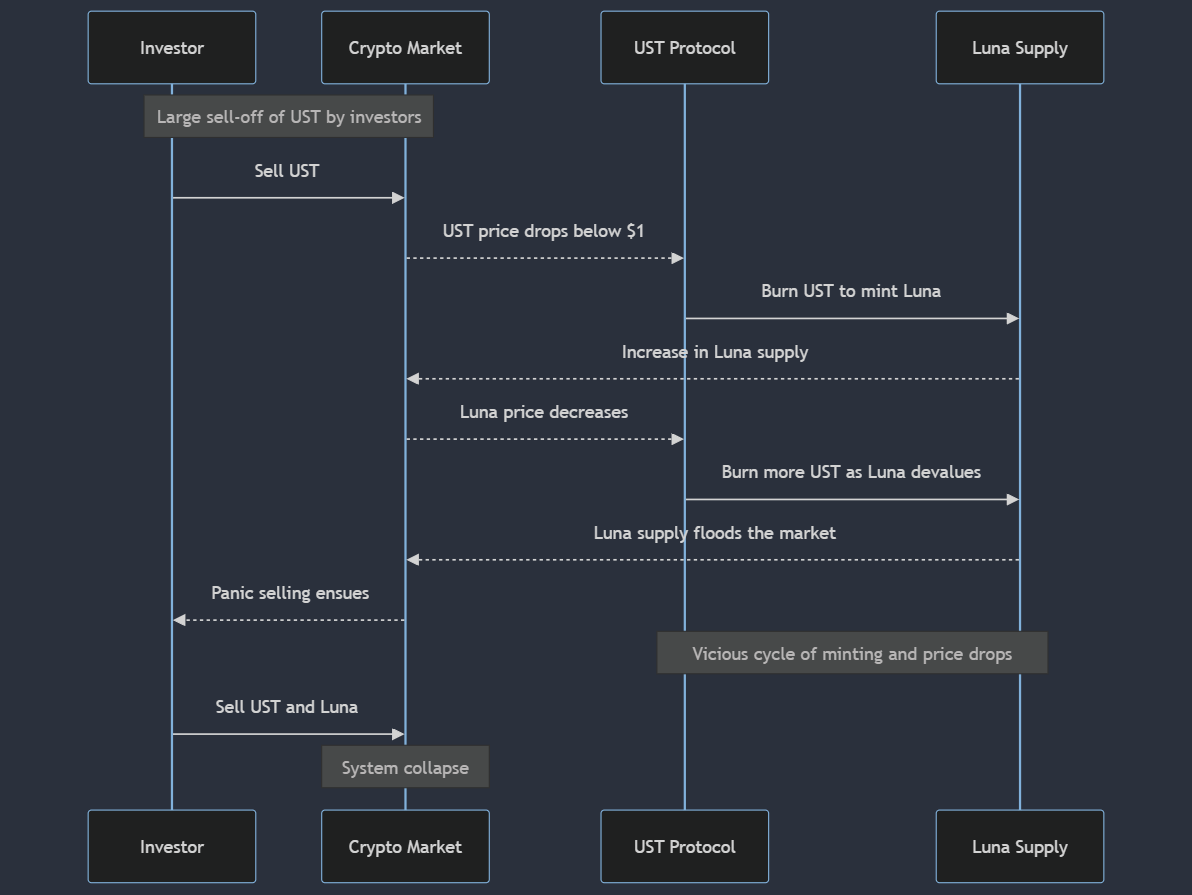

The Terra mechanism ensuring its algorithmic stablecoin $UST would keep its peg to the $USD was supposed to work like this, in case its price drops below $1:

But really, it worked like this when sh*t started hitting the fan... :

Once confidence in the system is lost, and panic sells settle in, you're done.

It was one of the biggest slaughtering in the industry, as an entire ecosystem got wiped out, taking dozens of projects with it while sinking. Billions were lost.

Hype vs Fundamentals

Retail investors in Web3 or crypto in general are often driven by hype and emotion. They hear about the latest shiny thing, get swept up in the excitement, and throw their money at it, hoping it'll stick. Influencers feed into this, pumping projects into the stratosphere with slick marketing and emotional appeals. The crypto space has even developed its own bizarre pride in being "degenerate" or "degens" and investing in projects that seem absurd.

In this chaotic market, traditional financial wisdom doesn't always apply immediately. What seems too dumb to work can go up to the moon overnight, driven by pure hype rather than solid fundamentals. People don't want to hear about the technical robustness of a project; they want to be part of the next big thing. So, it's all about whipping up excitement rather than communicating concrete value. Fundamentals however win over a longer timeframe, as they uncover mostly sustainability, not immediate price direction.

Ape short term, DYOR long term

Educated investors, despite coming with a methodical approach, can't just dismiss this wild west environment. They need to understand the madness, the meme culture, the irrational exuberance of the retail masses. If you can figure out where the crowd is going to blindly throw their money next, you can ride the wave without getting wiped out like them.

These retail investors might strike gold with a meme coin that blows up, but they rarely cash out at the right time. The potential big win turns into a massive loss after the inevitable dump, all because they didn't come to the party prepared.

So, you need to understand the retail mindset, but you can't become or stay like them. You must walk a fine line, embracing the irrationality of the crypto market while still applying methodical investment principles.

In the end, whether you think the crypto market is a sophisticated new frontier or a giant online casino, the reality is that it's both.