Navigating Through Crypto Opportunities & Scams

The Crypto industry is the "Wild West,". It is fraught with both opportunities and risks. Despite the potential for significant profits, the industry is riddled with scams, from fake ICOs to major DeFi hacks, due to the irreversible nature of crypto transactions and limited legal recourse. Billions are lost each year, and victims can be seen on social media almost every day.

To navigate this risky environment, investors must prioritize education in crypto security, use hardware wallets for asset protection, and exercise caution with new investment opportunities. As the sector matures, regulatory and security improvements are expected, but for now, individual cybersecurity awareness remains the best defense against fraud.

I was drained of everything this morning 😞

— Guy ¬¬ (@treefiresmoke) December 30, 2023

4 wallets

My main, 2 burners and my bonkbot trading wallet. All gone.

All NFT’s, all coins, even all the rugs and shitters completely wiped. Everything I’ve worked hard for and degen’d for since 2021. Gone in seconds.

I’ve seen… pic.twitter.com/nckn6qoT2W

The cryptocurrency industry often draws comparisons to the "Wild West" due to its lack of regulations and oversight. This frontier-like environment makes crypto an exciting place full of opportunities, but it also means there are numerous traps set by scammers and hackers ready to prey on the unwary. As the unfortunate victim in the post above experienced firsthand, years of hard work and savings can vanish in an instant if proper cybersecurity precautions are not taken.

Cryptocurrency scams have existed since the early days of Bitcoin. From fake initial coin offerings to Ponzi schemes like OneCoin, promises of easy money have attracted plenty of people willing to carry out fraud. Billions of dollars have been stolen over the years through complex hacking methods like flash loan attacks as well as simple phishing attempts. And DeFi protocols with coding vulnerabilities have led to exploits like the $320 million hack of Wormhole bridge.

The potential for high profits draws investors into the crypto space, often without much knowledge of the risks involved. The learning curve is steep – between storing seeds phrases, using hardware wallets, understanding smart contracts, etc. – leaving ample room for mistakes to be made.

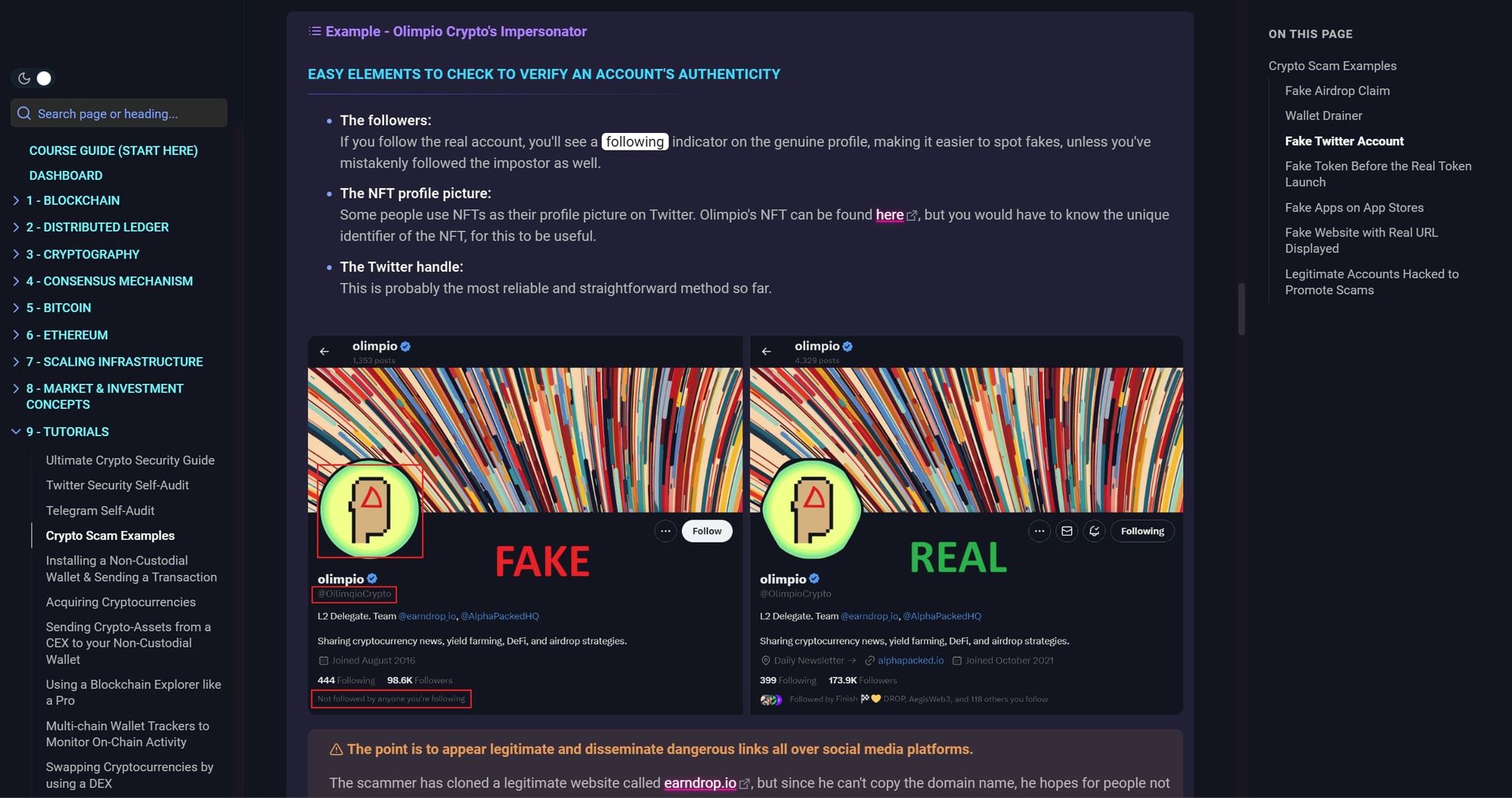

Scammers aggressively take advantage of this lack of familiarity, bombarding social media with giveaway scams, fake customer support accounts, malware links and more. They play psychological games to build trust before devastating their victims financially.

Once funds have been lost to a scam or hack, there is usually no way to get them back. Cryptocurrency transactions are designed to be irreversible, unlike credit card or bank payments which offer fraud protections. And with crypto still operating in legal gray areas in many countries, law enforcement intervention tends to be limited. This lack of recourse is precisely what draws criminals to targeting crypto users and protocols.

(See below a website referencing ongoing scam/hacks scandals in the industry)

How To Protect Yourself ?

Thorough education is key before putting any money into crypto. Understanding exactly how public/private key cryptography works, the security assumptions of blockchain technology, the coding auditing process for protocols looking to prevent hacks, etc, will provide a solid foundation.

Follow basic cyber hygiene

- Using non-SMS-based two-factor authentication on exchanges

- Avoiding clicking links from unknown sources

- Using a password manager

- Running antivirus software are also musts

- Utilizing cold storage solutions

Hardware wallets from established companies like Trezor and Ledger for example, paired with software hot wallets like Rabby, provide both security and more convenient access to funds when needed. Geographic redundancy also comes into play – if travel is feasible, storing cryptocurrency in multiple locations lowers risks from things like fire or flood damaging savings.

Do Your Own Research (DYOR) before Investing

Scrutinizing any new opportunities in the crypto space is also important before diving in. To effectively research in crypto, it's crucial to understand several key aspects:

- Technology: Grasping the project's underlying technology to assess innovation.

- Value Proposition: Evaluating what problem the project solves and its uniqueness.

- Financial Metrics: Reviewing revenue, Total Value Locked (TVL), Circulating Supply, Fully Diluted Value (FDV), and other indicators of success.

- Tokenomics: Analyzing the distribution and release schedule of tokens to understand market impact.

- Fundraising & Backings: Knowing which Venture Capital firms are associated with the projects.

- Market Trends: Keeping an eye on current market behavior and potential shifts towards the next crypto narrative(s).

- Checking communities like Twitter (X), Discord, Reddit, or Telegram, to see if others have identified any red flags with a new product or platform can also save a lot of headaches.

Understanding these elements requires more than just a casual approach; it involves delving deep into the project's fundamentals and market dynamics. This is essential to make informed decisions and avoid common pitfalls in the volatile crypto market.

If guarantees of high returns without risk are being made, that should immediately trigger skepticism – the saying "if it's too good to be true, it probably is" very much applies.

FREE COURSE SNEAK PEEK

The cybersecurity threats lurking within crypto may seem daunting, but educating oneself, following best practices, and being vigilant about scams can significantly reduce risks. There are no policies or insurance to fall back on here like with traditional finance. But taken together, the precautions mentioned above can help honest investors reap the outsized opportunities of crypto without losing everything at the hands of criminals.

Those willing to put in the effort to learn can saddle up and stake their claim while deterring the criminals looking to steal their hard-earned funds. Over time, regulations, insurance products and better platform/protocol security features will arise to tame this digital asset frontier further. But for now, investors' best protection comes from within – building up their own cybersecurity preparedness to lock down holdings against scammers and hackers.

Take the time to properly setup your OpSec, and the potential crypto payoff down the road may just be worth the dangers that lurk out there today.