Lessons from the Ashes of "DeFi 2.0" Ponzinomics

Game theory specialist Jordi Alexander wrote in 2022 a viral piece exposing Olympus DAO and other DeFi 2.0 hype machines as nothing more than high-tech Ponzi schemes. They had all this jazz about "protocol-owned liquidity" and "rebase mechanics", but at the end of the day, they were just printing more tokens like there's no tomorrow.

These projects promised insane yields and exploited our FOMO and tribal instincts to get us to buy in. Then, when the math couldn't hold up, the whole house of cards came tumbling down, wiping out billions in market cap and leaving a lot of "DeFi degens" high and dry.

Moral of the story; Don't believe the hype, do your own research, and remember that true gains come from actual revenue, not just clever math tricks and shiny buzzwords. And if you can't decipher what a project's really about, maybe save yourself the headache and pass on that "investment opportunity."

The Game Theory Equalizer

Let me tell you the story of how a single man destroyed an entire narrative and a league of elaborated Ponzis close to the top of the 2020-2024 crypto cycle. This man, is Jordi Alexander.

He who cannot remember the past is condemned to repeat it.

In January 2022, crypto investor Jordi Alexander published an in-depth exposé on Olympus DAO, one of the biggest "DeFi 2.0" projects at the time. His viral article peeled back the layers on Olympus' unsustainable tokenomics, catalyzing its precipitous decline.

By dissecting the clever ways those projects exploited human psychology and obscured mathematical truths, Jordi's piece became a case study on how even the most hyped-up projects can be fatally flawed Ponzi schemes.

Explore Core Issues / Opportunities

When Olympus emerged in early 2021, it took the crypto world by storm. The project seemed to solve one of decentralized finance's thorniest problems - providing sustainable liquidity for projects' native tokens. Its novel protocol-owned liquidity (POL) model was hailed as a breakthrough, a shining example of what they named DeFi 2.0.

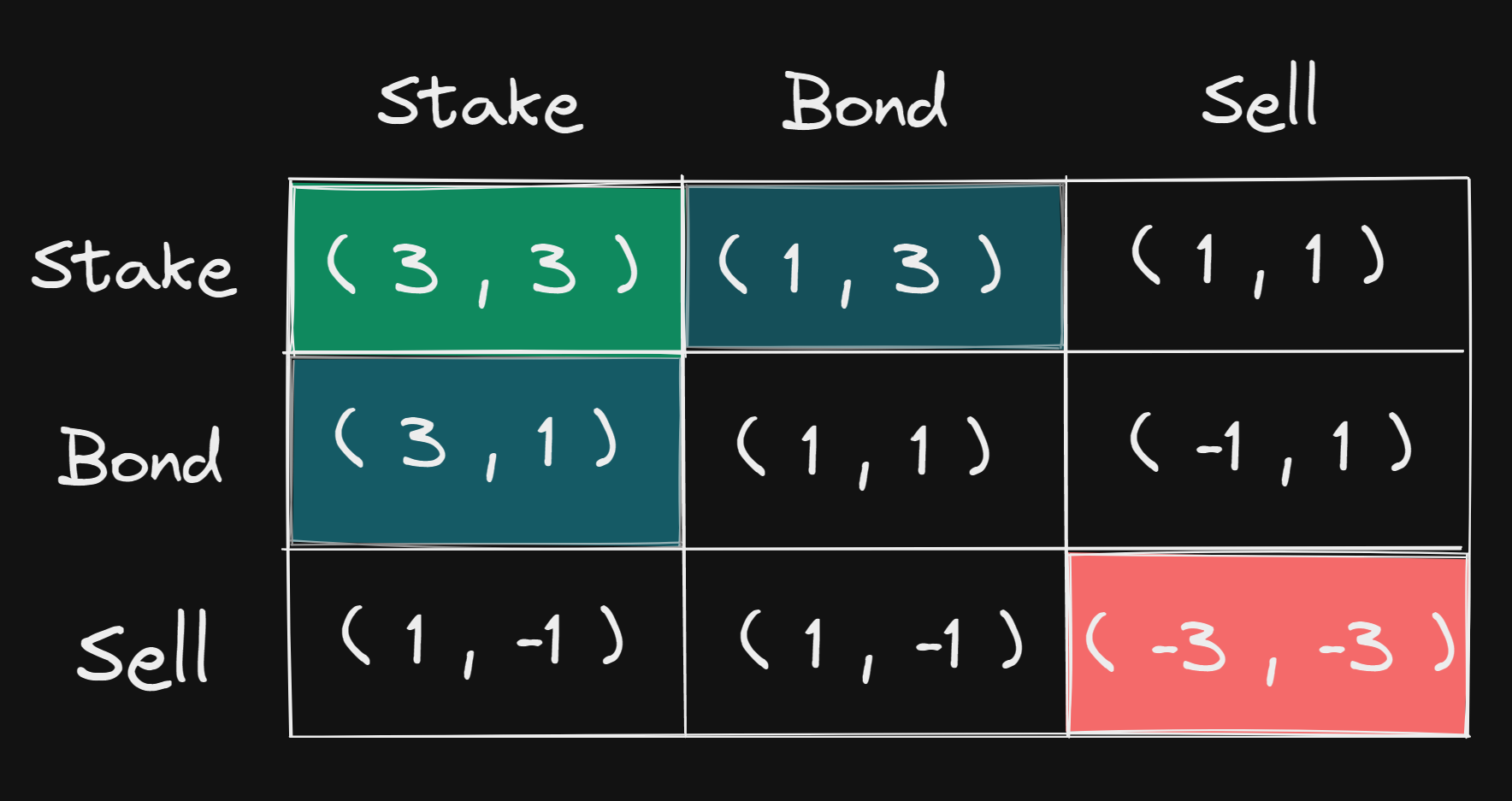

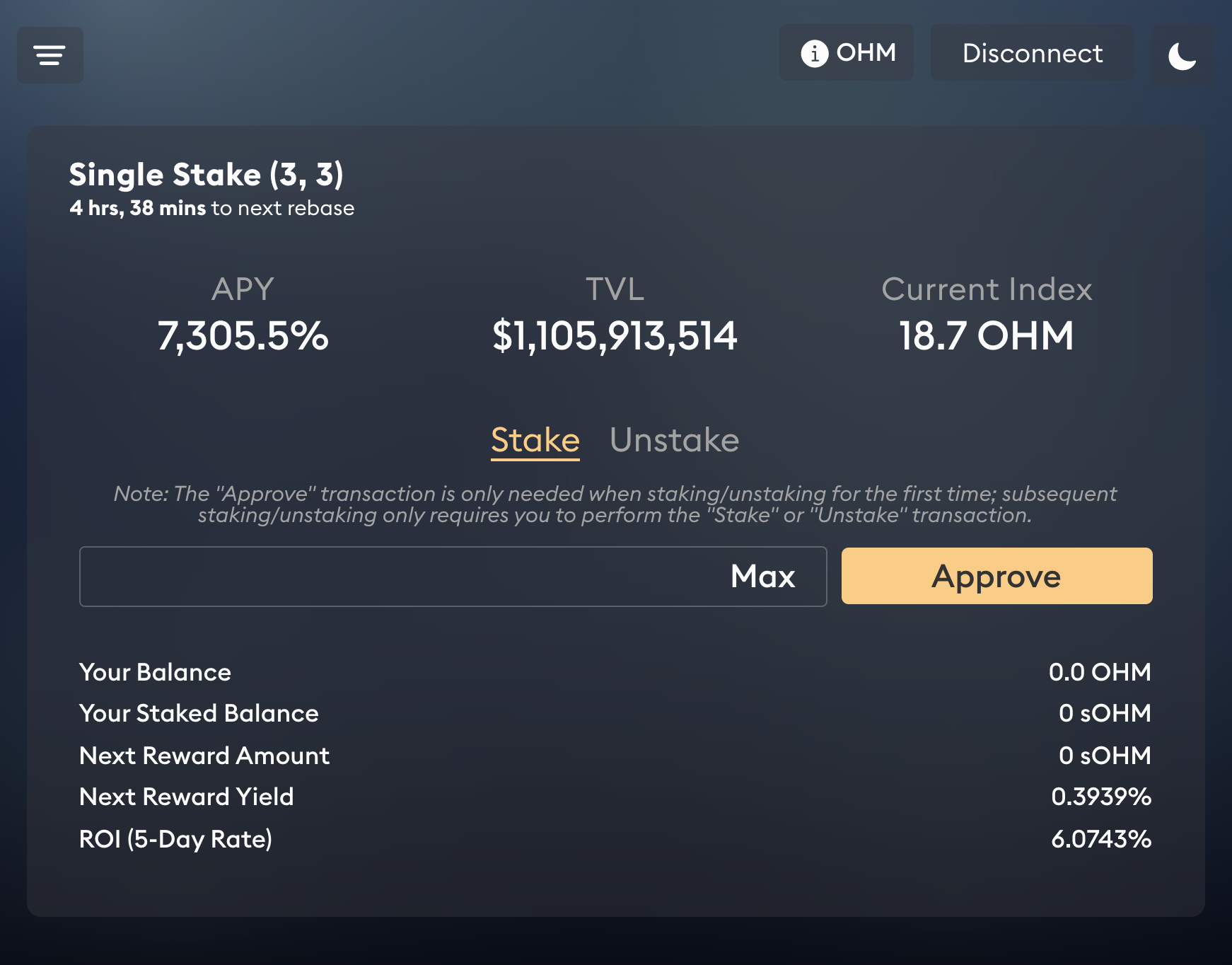

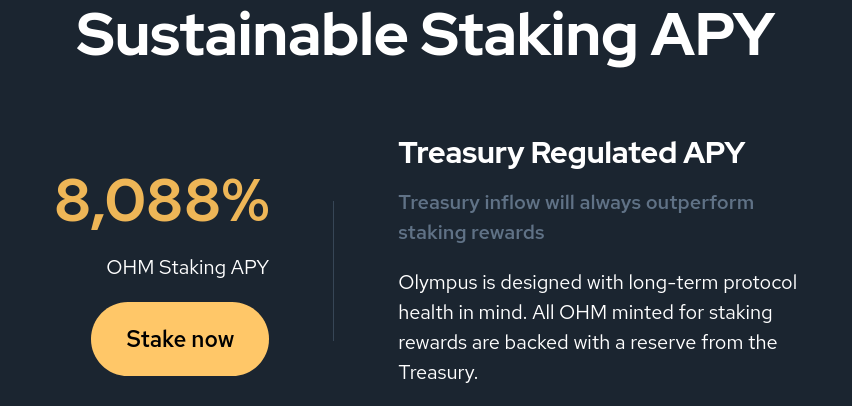

In those early days, it was easy to see why DeFi degens buzzed about Olympus. The triple digit APYs (Annual Percentage Yield) were eye-watering. Its use of bonding mechanisms to acquire liquidity was ingenious. And its community rallied around the "3,3" meme, cooperating to stake OHM and maximize yields in a display of game theoretic coordination.

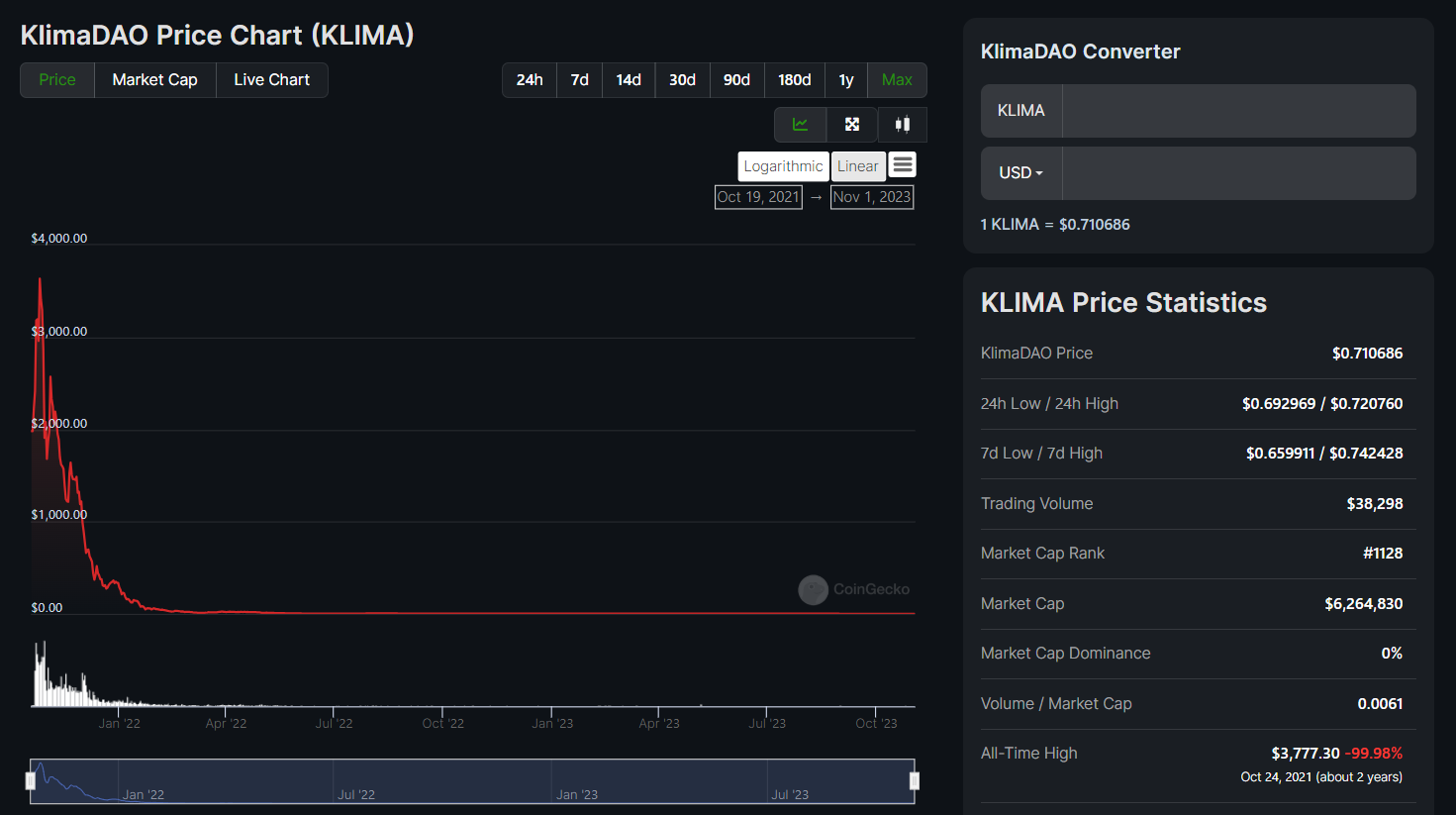

Just months after launch, Olympus' governance token OHM exploded from obscurity to over $1400 per token. Its market cap exceeded $4 billion at the peak. Olympus became the symbol of a new wave of community-driven decentralized finance.

But in crypto, the higher the rise, the steeper the fall. OHM has since collapsed over 99% from its highs. Once heralded as the vanguard of DeFi innovation, Olympus is now labeled a Ponzi scheme by many former advocates.

It aimed to solve liquidity sustainability via its protocol-owned liquidity model. Complex rebasing mechanics obfuscated the cold hard math: at its core, Olympus relied on a constant stream of new capital to stay afloat. Hype around DeFi 2.0 and dreams of becoming "reserve currency" boosted adoption. But tokenomics were fatally flawed.

Deep Dive into Core Issues

1. Smoke and Mirrors Tokenomics

Olympus advertised yields upwards of 7,000%, but these were simply minting more tokens to distribute. No actual wealth creation occurred.

Rebase mechanics continuously inflated supply, diluting holdings of existing users. But this was masked by complex math and modeling.

Backing OHM with a treasury reserve provided false confidence. But the token supply grew much faster than treasury assets.

2. Exploiting Human Psychology

The followings are elements you may encounter in future projects and which should alert you:

- Extreme APY appealing greed and FOMO without regard for consequences.

- Social belonging and "community" aspects exploit tribal instincts.

- Vague "store of value" pitch provides an illusion of legitimacy.

- Reassurances of "safety" give comfort against niggling doubts.

3. Obscuring the Grim Reality

Confusing terminology like "rebase" muddies token dilution effects. Abstract equations skirt the simple math revealing eventual value decay.

Distractions like NFTs or "partnerships" divert attention from core flaws. Silence about founders' special "pOHM" tokens hid an insider enrichment scheme. The founders and early investors got rich by offloading OHM onto gullible latecomers

The Fall - Compounding Crashes

Olympus' decline was less a collapse and more a series of compounding crashes. Each damaged layer accelerated the next. Here's an overview:

- As yields dropped, staking became less attractive, reducing buying pressure.

- Speculators started exiting, popping the exponential price bubble. OHM began decoupling from the treasury value.

- To maximize yields, degens turned to leverage, borrowing stablecoins against staked OHM. This worked while prices climbed but proved disastrous on the way down.

- As the price collapsed, these overleveraged positions were ruthlessly liquidated, flooding the market with more OHM and fueling further crashes.

- With prices in freefall, faith in the protocol dwindled. Concerns around sustainability and solvency mounted. Confidence was shaken.

- Former fans flipped to critics. Many who once praised Olympus' innovation now declared it an outright scam. Calls to prosecute the founders spread.

- Attempts to restore trust were undermined by complexity. Most users couldn't evaluate the protocol fundamentals through the intricate mechanics.

- Ultimately, Olympus fell victim to its own success and hype. The higher it flew on speculation, the more damage resulted when sentiment turned.

Lessons from the DeFi 2.0 Era

Jordi's exposure of Olympus and the multiple forks emulating the same tokenomics provides several timeless lessons:

- Look past hype and FOMO to critically assess fundamentals.

- Understand exactly how tokenomics work, don't rely on buzzwords or jargon.

- Question where advertised yields actually come from.

- Watch for ways founders enrich themselves versus regular users.

- Ponzi mechanics can sustain projects for a while, but eventually collapse.

- Long-term sustainability relies on genuine revenue streams, not just on the issuance of new tokens.

If you want to avoid getting drawn into cleverly disguised crypto Ponzis, educate yourself. And if you have the stomach for it, here is Jordi's masterpiece.

I'll leave below other Olympus like projects that all met their fate.