What is Algorithmic Events-based Trading?

Algorithmic trading, the use of computer-driven strategies, is making big waves in crypto. Why? It’s fast and removes human emotion, catching price changes that happen in a blink. Especially when big crypto news drops, these algos act instantly, making moves most traders can't.

Mixing algo trading with event-driven strategies is a game changer. Think of it as a computer quickly buying or selling based on fresh news. Big crypto events, like new rules or major updates, are prime times for these trades.

Looking ahead, expect more traders to use algos. They're not just for experts anymore. Everyone from big firms to everyday traders can benefit from these. That's what Artemis Digital intends to provide.

Algorithmic trading has exploded in popularity across financial markets over the past decade. As crypto matures, algos are becoming more prevalent and sophisticated. When combined with event-driven strategies, algorithms can rapidly analyze information and capitalize on volatility catalyzed by major news or releases. This evolution is likely to increase efficiency in crypto markets.

Introduction to Algorithmic Trading

The term refers to using computer programs and algorithms to execute trades automatically based on predefined strategies and market data. It enables traders to implement rules-based systems that can monitor markets, analyze new information, and act on trading opportunities faster than any human.

Algorithms make trading decisions based on logic, removing emotion from the equation. They can scan market data 24/7, identifying trading opportunities whenever they arise. Algorithmic systems can ingest multiple data sources, process signals, and place orders in milliseconds. This high-speed execution provides consistency and efficiency difficult for human traders to match.

The most common algorithmic strategies include:

- Trend following - Uses indicators like moving averages to determine market trend direction and trades accordingly. Buys and holds assets in uptrends, sells in downtrends.

- Mean reversion - Identifies when asset prices diverge significantly from historical averages and executes trades anticipating the price will revert back towards the mean.

- Arbitrage - Seeks to capitalize on discrepancies in asset prices across different exchanges and platforms. Buys assets on one exchange where the price is lower and simultaneously sells where prices are higher.

- Market making - Provides liquidity to exchanges by placing simultaneous buy and sell limit orders and seeking to profit from the spread between bid and ask prices. This also increases market liquidity.

As crypto markets have grown, they have become appealing targets for algorithmic trading. Digital assets tend to be volatile, with frequent large price swings. This volatility is often driven by news, announcements, protocol upgrades, exchange listings, and other events.

Humans struggle to react quickly enough to capitalize on these swift price movements. Algorithms can monitor markets, instantly process new data, and fire off orders within milliseconds. This gives them an edge in fast-moving crypto environments.

Top Advantages of Algorithmic Trading:

- Speed - Rapid order execution allows algorithms to take advantage of fleeting opportunities. Humans simply can't match the reaction time.

- Emotionless rules-based decisions - Algorithms strictly follow programmed logic and rules. They don't experience fear, greed, or other biases that distort human decision-making.

- Consistency - Algorithms execute the exact same strategy during all market conditions. Humans are prone to changing approach and over-optimizing strategies.

- Scalability - Trading systems can be expanded to multiple markets and assets simultaneously. Difficult for human traders to effectively scale.

- Constant monitoring - Algos monitor markets and data sources 24/7. Humans must sleep and disconnect.

Real Historical Case of Event-driven Matket Volatility

On March 6 2022, Influential figure and highly respected developer Andre Cronje, famous for pioneering the first decentralized automated hedge fund Yearn Finance, decided to quit in the middle of the release of his new project Solidly.

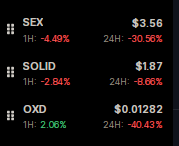

The Market reaction was immediate:

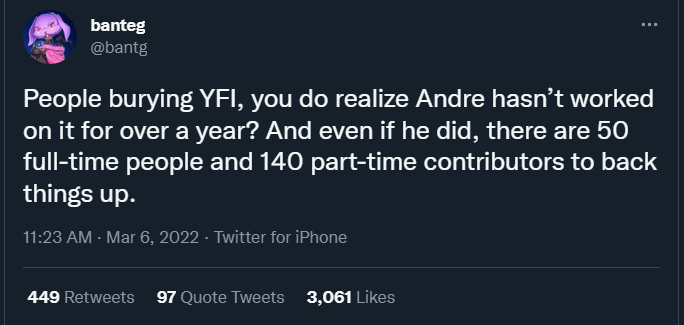

Yearn Finance lead developer known as Banteg tweeted about the market reaction, which also immediately triggered a counter-movement:

The Total Value Locked (TVL) on Fantom Blockchain took roughly a year to recover from this event, which was short-lived nevertheless, as the bear market had already begun.

Combining Algorithms with Event Trading

While algorithms have powerful advantages, they lack contextual understanding of events and news that move markets. This is where combining algorithms with event-driven strategies becomes highly effective.

Traders seek to capitalize on volatility and price movements around major news events, product launches, protocol upgrades, and other releases. However, the challenge is reacting quickly as events occur. This is where algorithms shine.

Here are some of the key ways algorithms are enhancing event-driven crypto trading:

- Scanning news and social media to detect major events before they occur. This allows time to plan.

- Analyzing historical data around similar past events to identify trading patterns.

- Placing orders simultaneously with event occurrence to capitalize on immediate volatility.

- Rapidly analyzing market reactions to events and autonomously placing trades based on price movements.

- Continuously learning from past event reactions using machine learning to improve future trading decisions.

- Identifying arbitrage opportunities between futures prices and spot prices during events.

- Executing trades based on event signals generated by human traders.

Major Crypto Events Ideal for Algo Trading

There is no shortage of impactful events in crypto that algorithms can extract value from. Here are some of the most substantial:

- Bitcoin halvings - Occur every 4 years, halve Bitcoin mining rewards. Historically catalyze bull markets.

- Ethereum network upgrades - e.g. the upcoming EIP-4844, expected in Q4 of this year, which will likely have a positive impact on ETH and Layer 2 tokens such as ARB and OP.

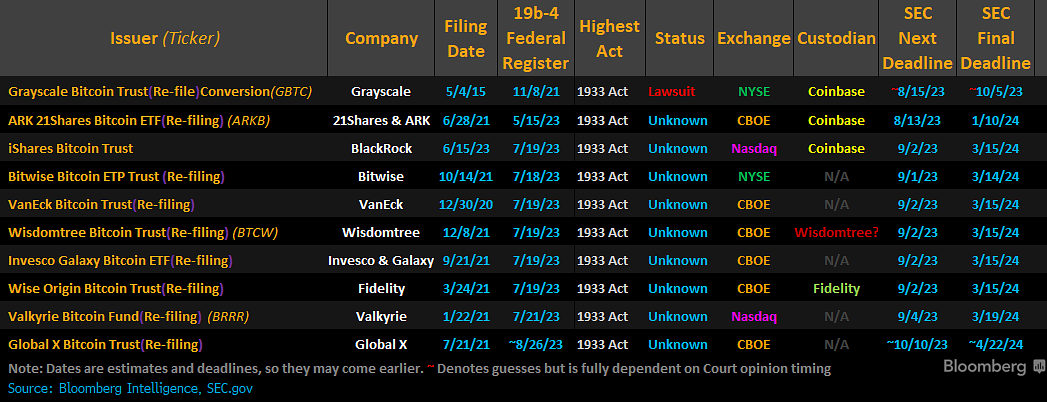

- Regulation changes - Positive (ETF approvals) and negative (exchange restrictions) produce volatile price swings.

- Interest rate decisions - Federal Reserve announcements significantly impact crypto markets.

- ICO launches - Highly anticipated initial coin offerings lead to swift price movements.

- Exchange listings - Assets added to major exchanges like Coinbase see immediate volatility.

- Macroeconomic news - CPI, unemployment, GDP. Major traditional market news cascades into crypto.

- Institutional adoption - Headline announcements from major banks, funds, corporations entering crypto.

Each event type exhibits unique patterns and tendencies algorithms can be programmed to exploit. But the common thread is volatility and swift market movement as participants react to new information. This is the perfect environment for algorithmic trading strategies to thrive.

Below is a list of events slated to occur, relative to the time of this article's publication:

Long-Term Evolution of Algo Trading in Crypto

The combination of speed, efficiency, scalability, and analytical capabilities possessed by algorithmic trading systems will ensure they become an integral part of crypto markets in the long-run. There are several key ways we are likely to see the continued evolution of algo trading:

- Increased adoption by hedge funds and prop trading firms. Algorithms can be coded by top quant developers and data scientists.

- More retail accessibility through cloud-based services, allowing anyone to leverage algos with no coding needed.

- Open-source algorithms and platforms that make sophisticated strategies available to a wider audience.

- Greater focus on machine learning and AI to increase performance, predictive accuracy, and adaptability to changing market conditions.

- Hybrid model incorporating algorithms with human oversight and discretion for trading major events.

- Further specialization and innovation around strategies tailored specifically to trade events vs general market making/arbitrage algos.

- Deeper liquidity provision on exchanges by algorithms leading to tighter spreads, less slippage, and reduced volatility.

While algorithmic trading is still gaining mainstream adoption in crypto, expect its usage and sophistication to rapidly increase. Algos are unlikely to fully replace human trading. But their performance and importance around major events will likely continue growing.

Traders who embrace this evolution and learn to effectively leverage algorithms will gain an edge. Those who adapt and experiment with creative algorithmic strategies will be best positioned to profit as adoption accelerates.

Conclusion

The combination of speed, analytic capabilities, and imperviousness to emotion possessed by algorithms will increasingly tilt the odds in their favor. While human trading insight and oversight remains crucial, the rise of algorithms is inevitable.

As crypto markets continue to mature, traders would be wise to embrace this evolution. Experimenting early with algorithmic strategies will provide valuable learning and experience. Adopting algos can realistically improve results and maximize opportunities driven by major events.

Artemis Digital is launching its first set of algorithmic event-driven trading tool this year, so stay tuned. We believe the future performance of traders will greatly depend on their ability to utilize technology to their advantage. Algorithms are the manifestation of that technology, and the time to start implementing them is now.